LIC Index Plus is a regular premium payment, non-participating, Unit Linked Insurance Plan. Index Plus plan offers insurance-cum-savings. Proposer can choose the amount they want to pay for the premium. Each premium paid shall be subject to allocation charges. On completion of specified policy term, Guaranteed additions as a percentage of Annualized Premium shall be added to the unit fund under in force policy.

LIC Index Plus policy details

| Minimum Entry Age | 90 days |

| Maximum Entry Age | 50 years under Basic Sum Assured is 10 times of Annualised Premium 60 years under Basic Sum Assured is 7 times of Annualised Premium |

| Minimum Maturity Age | 18 years |

| Maximum Maturity Age | 75 years under Basic Sum Assured is 10 times of Annualised Premium 85 years under Basic Sum Assured is 7 times of Annualised Premium |

| Policy term | 15 to 25 years for Annualised Premium less than ₹48,000 10 to 25 years for Annualised Premium ₹48,000 and above |

| Minimum Premium | Yearly – ₹30,000 Half Yearly- ₹15,000 Quarterly- ₹ 7,500 Monthly NACH – ₹ 2,500 Premium in multiple of ₹ 250 for Monthly NACH and in multiple of ₹ 1,000 for other modes. |

| Maximum Premium | No limit |

| Date of Commencement of Risk | For age at entry less than 8 years: On completion of 2 years from DOC or on Policy Anniversary coinciding with or following the completion of 8 years of age, whichever is earlier. For age at entry 8 years or more: Risk will commence immediately. |

| Death Benefit | Before Commencement of Risk: Fund Value After Risk Commences: Basic SA or 105% of Total Premiums Paid (less any Partial Withdrawals made during last 2 years) or Fund Value whichever is higher. |

| Basic Sum Assured | 7 times OR 10 times of Annualized Premium for Age 90 Days to 50 years. 7 times of Annualized premium for Age 51 to 60 years. |

| Maturity Benefit | Fund Value + Refund of Mortality Charges (Excluding any extra premium and Taxes on Mortality Charges) |

| Fund Options | Flexi Growth Fund and Flexi Smart Growth Fund |

| Available Riders | Accident Benefit Rider |

| Other Options | 1. Switching between any fund types. 2. Death Benefit in installments for 5 years. 3. Partial Withdrawal from 6th year. 4. Increase/Decrease in Benefits not allowed. 5. Accident Rider can be cancelled. 6. Top Up not allowed. 7. Alteration to another Plan is not allowed. |

| Mode of Premium Payment | Yearly Half Yearly Quarterly Monthly Nach only |

| Grace Period | 15 days for monthly mode and 30 days for other modes |

| Policy Loan | Not Available |

| Surrender/Paid up | Allowed After 5 years. |

| Revivals | Within 3 years of FUP |

| Discontinuation after 5 years | If the policy is not revived within 3 years of the first unpaid premium, then the fund value will be paid at the end of 3 years or Maturity, whichever is earlier. |

| Cooling off | 30 Days from the date of receipt of the Policy in Physical/Electronic mode, whichever is earlier. |

| Suicide Clause | Only Fund Value is payable. |

| Back Dating | Not Allowed. |

| Proposal Form | Separate form. |

| Tax Benefits | On Basic Premiums: u/s 80C Maturity: Tax-Free u/s 10(10D) under Basic Sum Assured is 10 times of Annualised Premium and Taxable under Basic Sum Assured 7 times of Annualised Premium. Death Benefit: Tax-Free |

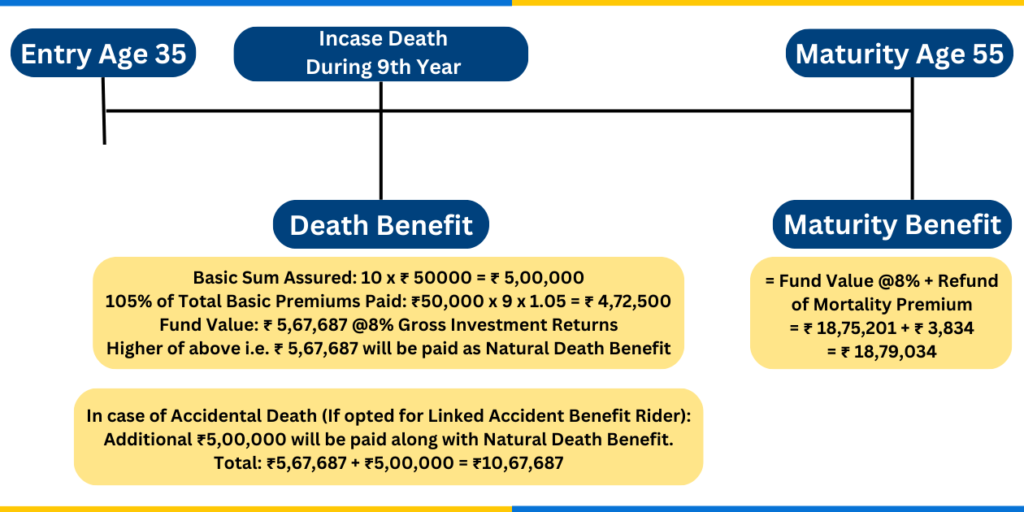

Example of LIC Index Plus Policy

Age- 35

Term – 20 years

Annualised Premium ₹ 50000

Fund Flexi Growth Fund

Basic Sum Assured:10 times