LIC Jeevan Labh Plan is a limited-year premium payment, with profits, non-linked, individual Endowment Plan. Jeevan Labh Plan offers an attractive combination of protection and savings features. This combination provides a lump sum amount at the time of maturity for the policyholder and financial support for the deceased policyholder’s family in case of the policyholder’s unfortunate death at any time before maturity. This plan also takes care of liquidity needs through its loan facility.

LIC Jeevan Labh Policy details

| Minimum Entry Age | 8 years |

| Maximum Entry Age | Term PPT Max Entry Age 16 years 10 years 59 years 21 years 15 years 54 years 25 years 16 years 50 years |

| Maximum Maturity Age | 75 years |

| Policy term | Term Premium Paying Term 16 years 10 years 21 years 15 years 25 years 16 years |

| Minimum Sum Assured | ₹2,00,000 and in multiples of ₹10,000 thereafter |

| Maximum Sum Assured | No limit |

| Sum Assured on Death | Basic Sum Assured |

| Death Benefit | Sum Assured on Death + Vested Bonus + Final Additional Bonus if any. |

| Maturity Benefit | Basic Sum Assured + Vested Bonus + Final Additional Bonus if any. |

| Maturity or Death Claim in Installments | Maturity or Death Claim in Installments for 5/10/15 years for Full or Part of Maturity or Death Claim Amount This Option to be exercised – 3 months before Maturity and for Death Claim during lifetime by Life Assured. |

| Available Riders | ADDB (Accidental Death Disability Benefit) or Accidental Benefit Rider, Term Rider, Critical illness Rider and Premium Waiver Benefit Rider up to age 25 of child. |

| Mode of Premium Payment | Yearly Half Yearly Quarterly Monthly (SSS and NACH only) |

| Mode Rebate | Yearly : 2% Half Yearly : 1 % |

| High Basic Sum Assured Rebate | Upto 4.90 lacs : Nil 5 lacs to 9.90 lacs : ₹ 1.25 % of Basic SA 10 lacs to 14.90 lacs : ₹ 1.50 % of Basic SA 15 lacs & Above : ₹ 1.75 % of Basic SA |

| Grace Period | 15 days for monthly mode and 30 days for other modes |

| Claim Concessions | Available under Base Plan only. Not apply to Riders and Death due to Suicide. |

| Paid up, Surrender, Policy Loan | Available after payment of premium of 2 full years. |

| Revivals | Within 5 years of FUP. |

| Back Dating | Allowed with lean Month’s benefits. |

| Proposal Form | 300, 360 |

| Cooling off | 30 Days from the date of receipt of the Policy in Physical/Electronic mode, whichever is earlier. |

| Tax Benefits | On Basic Premiums: u/s 80C Maturity/Death Benefit: Tax-Free u/s 10(10D) under Basic Sum Assured is 10 times of Annualised Premium |

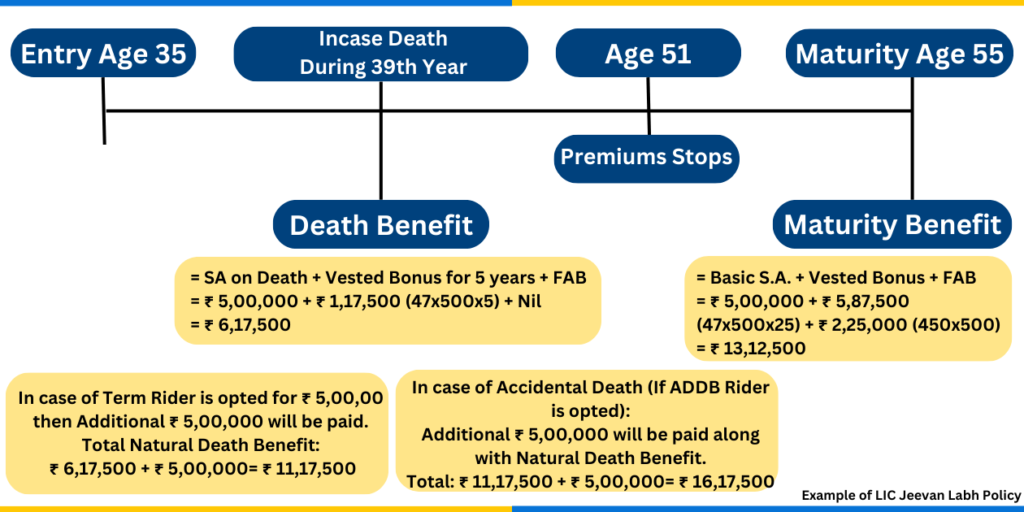

Example of LIC Jeevan Labh Policy

Age: 35 years

Sum Assured: ₹ 50000

Policy Term: 25 years

Premium Paying Term: 16 years